Lib Dems Call for Family Farms Tax U-Turn as Record Number of Farms Close

The Welsh Liberal Democrats have renewed their call for the UK Labour Government to reverse its changes to inheritance tax on family farms, as new data shows closures in the agricultural sector have hit record highs.

According to the Office for National Statistics (ONS), 6,365 agriculture, forestry and fishing businesses shut down over the past year, the highest figure since records began in 2017. Only 3,190 new businesses were created in the sector, leaving a net loss of 3,175.

The sharp decline has coincided with the announcement of Labour’s so-called “Family Farms Tax.” Introduced by Chancellor Rachel Reeves in October 2024, the change will cap inheritance tax relief on agricultural land from April 2026. A 20 per cent tax will apply to land inherited above £1 million, ending the current full exemption from the standard 40 per cent inheritance tax rate.

The majority of closures took place in the six months following the policy’s announcement, suggesting the prospect of future tax burdens is already driving families out of farming. Farmers and rural groups warn that the change will force families to sell off land simply to pay inheritance tax, even if they intend to continue farming.

The Welsh Liberal Democrats argue this policy will hit rural Wales particularly hard, weakening both the farming economy and wider supply chains.

They have also warned that the policy could have a significant impact on the Welsh language, with 43% of agricultural workers speaking Welsh, significantly higher than the general population in Wales, any policy that forces farmers to sell up and move out of farming could have disastrous consequences on the survival of the language in rural communities.

The changes come amid wider challenges for farmers, including rising costs, increased bureaucracy, and post-Brexit trade disruption. The latest data also shows a downturn in farm investment, reflecting uncertainty across the sector.

The Liberal Democrats are calling for a full U-turn on the Family Farms Tax and are instead urging the Government to raise revenue by taxing the profits of the big banks.

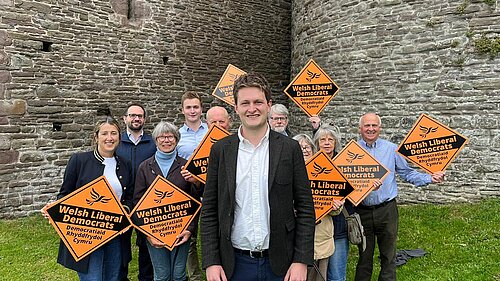

Commenting, Welsh Liberal Democrat Westminster Spokesperson David Chadwick MP, said:

“Family farms are the heart of rural Wales, but this Labour Government is tearing that heart out. By slapping a tax bill on the next generation just for keeping their parents’ farm going, Labour will force local farms to be chopped up and shut down.

In my constituency, generations have worked tirelessly to feed our country and protect our countryside. They deserve support, not a tax raid that risks forcing them off the land.

I am calling on the Chancellor to reverse course before more Welsh family farms are lost forever. We need a government that backs rural Wales, not bankrupts it.”

ENDS

Sign up

for email updates